- People

- Expertise

Der 10.000 Stunden-Unterschied

Wussten Sie, dass 10.000 Stunden „entwickelter Praxis“ als Marke gilt, ab der man ein Experte oder eine Expertin ist? Gute Nachrichten: Jeder gunnercooke Partner und jede gunnercooke Partnerin hat schon mehr als 10.000 Stunden anwaltlich gearbeitet. Sie haben hier also nur mit ausgewiesenen Rechts-Expert*innen zu tun.

- Our Approach

- News & Insights

- Join Us

- Get in Touch

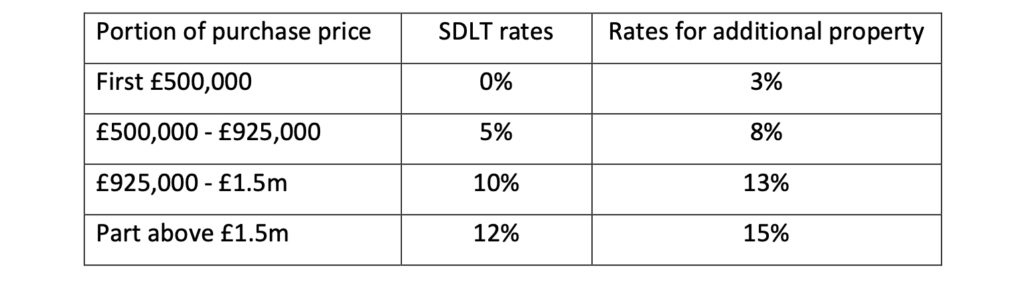

All purchasers of residential property in England and Northern Ireland will benefit from a reduction in SDLT for transactions that complete on or after 8 July 2020 and before 1 April 2021. The threshold of the nil rate band is being raised from £125,000 to £500,000, so now any purchase of a home up to £500,000 will not attract any duty.

The benefit of the increased nil rate band also applies to purchases for more than £500,000, so a purchase of a home for £700,000, will result in SDLT of £10,000, with duty at the rate of 5% being payable on the £200,000 portion of the purchase price above the £500,000 nil rate band threshold. A buyer of a home for £500,000 or more will now save £15,000.

First-time buyers relief which applies to the purchase of a first home for not more than £500,000, and gives exemption on the first £300,000 and a 5% rate of duty on the remainder, is now less generous than the new measure, and therefore First time buyers relief is replaced by this new temporary measure.

Where the residential property being purchased is an additional property, such as a second home or a purchase by a buy to let landlord, the supplemental 3% charge will apply to the new bands.

Here is a summary of the new measures:

Leases granted at a premium will also benefit from the increased nil rate band, as will the net present value of the rent over the term of the lease.

If you have any questions on these temporary reduced rates of SDLT please give Tax Partner, Julian Moran, a call on 07500 162 767.